If you're at the point in your life where you're financially secure enough to buy an apartment instead of renting it in New York City, you probably should.

We mean, buying an apartment is an investment for your future whereas renting an apartment is only an investment for right now, if that.

Still, obviously, renting an apartment month by month is definitely less impactful financially than flat out buying an apartment. Or is it?

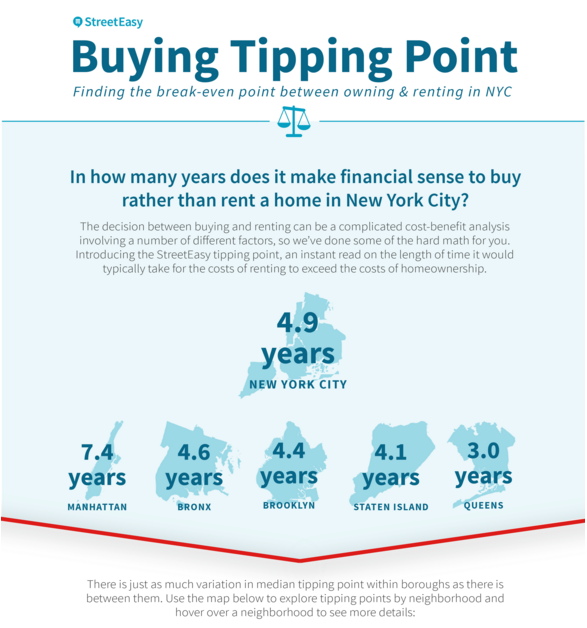

It turns out that in NYC, it makes financial sense to buy your apartment instead of renting if you intend to stay there for 4.9 years or longer.

How does that tiny number of years make sense?

Well, right now it's more expensive than ever to buy and rent properties in New York City. So expensive, in fact, that 3% of NYC's apartments are currently vacant.

Hence, StreetEasy's Tipping Point, the new metric that calculates the number of years it would take for owning a home to equal the costs of renting one in the same area.

We were flabbergasted by the suggestion that it'd only take five years to make owning an apartment in NYC worth it. Especially since conventional wisdom preaches to buy a home only if you plan on living in it for the next 50 years.

However, real estate prices in NYC rose 31% between 2005 and 2015, and they're only going up. So buying might make sense.

If you rent your apartment, you have to pay monthly rent, broker's fees (unless you have Oliver), rental insurance, rent inflation, rent deposit, and condo fees.

[anad]

If you buy your apartment, you have to pay a mortgage principal and interest, property taxes, buying and selling costs, annual maintenance, renovation, and homeowners insurance.

At some point, the benefits you'd earn in mortgage interest deduction and home value appreciation tip the scales, so that it'd be more financially responsible for the long-term to buy your apartment rather than renting it.

Home value appreciation is big. Since rental and homeowner prices are higher than ever and still rising, your apartment is definitely likely to be much more valuable in the future than it is today.

All this is to say, if you're planning on staying in your apartment for five years or longer, don't throw the question of buying away so fast. It might be worth it.

If you're not in a position of financial flexibility where buying is an option, then use Oliver to rent your next apartment so you won't have to pay a ridiculous broker's fee.

It's a free NYC rental app, and it's making broker's fees obsolete. So, whether you buy your apartment or rent with Oliver, you'll still win. Saving money on your apartment in NYC means victory, and victory is sweet. Download the Oliver app for iOS here. Don't have an iPhone? They've got it for Android here.

Do Yourself a Favor and Download the Oliver App Here.

[via Streeteasy] [Feature Image Courtesy Brick Underground]